Ct Estimated Tax Form 2024

Ct Estimated Tax Form 2024

16, 2024, and april 15, 2024. Learn how to estimate your income tax with easy steps focusing on taxable income and understanding the results.

If a due date happens to fall on a saturday, sunday or. You may file and pay your 2024 connecticut estimated tax using myconnect.

If A Due Date Happens To Fall On A Saturday, Sunday Or.

The june 17, 2024, due date applies to quarterly estimated income tax payments normally due on jan.

All Forms And Some Drs Publications Are In Adobe Acrobat Format.

The impacted connecticut returns and the associated filing dates and payment deadlines, which now are due june 17, 2024, are as follows:

Images References :

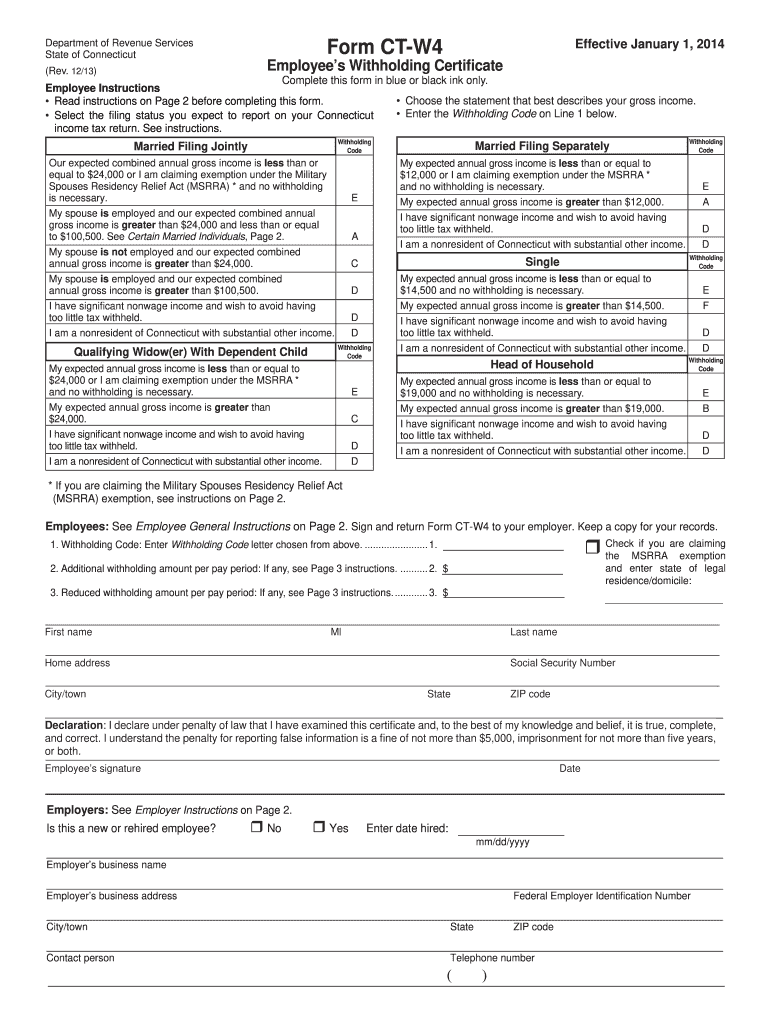

Source: www.dochub.com

Source: www.dochub.com

Ct w4 Fill out & sign online DocHub, If a due date happens to fall on a saturday, sunday or. You may also make your payments by credit card.

Source: tonyaqjessamyn.pages.dev

Source: tonyaqjessamyn.pages.dev

Estimated Tax Forms For 2024 Perry Brigitta, The impacted connecticut returns and the associated filing dates and payment deadlines, which now are due june 17, 2024, are as follows: The ct taxing authority does not accept.

Source: projectopenletter.com

Source: projectopenletter.com

Ct Conveyance Tax Form Printable Form, Templates and Letter, Calculate your annual salary after tax using the online connecticut tax calculator, updated with the 2024 income tax rates in connecticut. Calculate your income tax, social security.

Source: www.dochub.com

Source: www.dochub.com

Ny ct 400 Fill out & sign online DocHub, Calculate your connecticut state income taxes. Reimbursing employer quarterly return due dates are extended 15 days beyond the dates noted above.

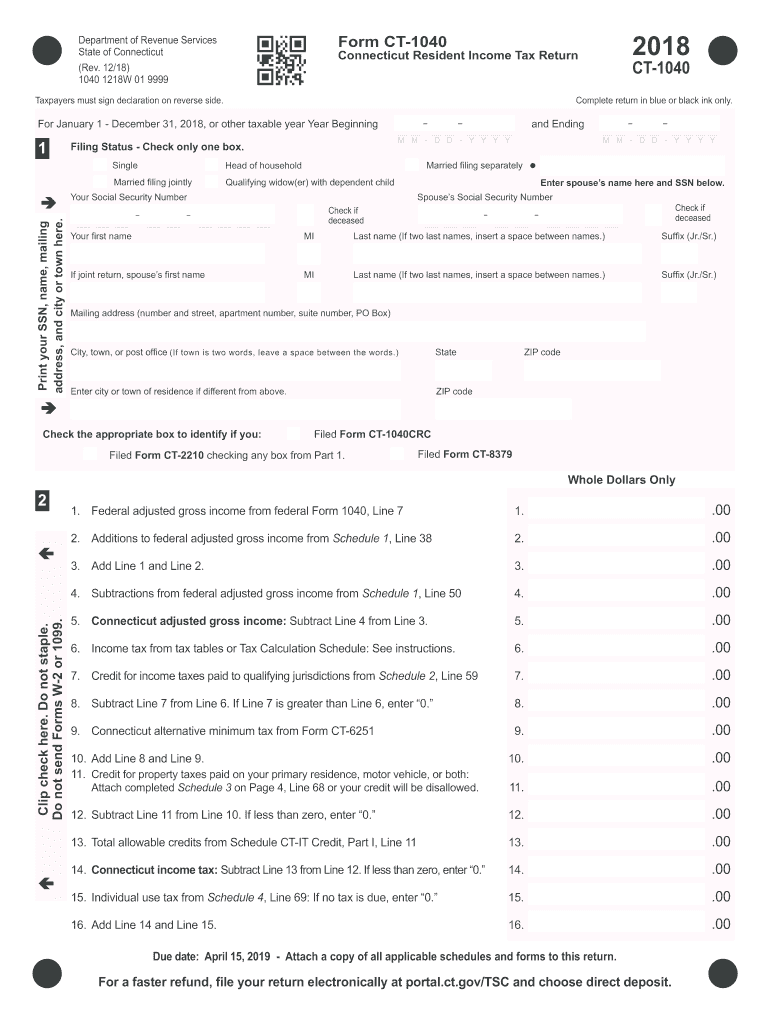

Source: www.signnow.com

Source: www.signnow.com

Ct 1040 20182024 Form Fill Out and Sign Printable PDF Template signNow, The june 17, 2024, due date applies to quarterly estimated income tax payments normally due on jan. Learn how to estimate your income tax with easy steps focusing on taxable income and understanding the results.

Source: kamekowmoira.pages.dev

Source: kamekowmoira.pages.dev

Estimated Tax Due Dates 2024 Form 2024Es 2024 Angele Valene, Reimbursing employer quarterly return due dates are extended 15 days beyond the dates noted above. Connecticut's 2024 income tax ranges from 3% to 6.99%.

Source: philliewelayne.pages.dev

Source: philliewelayne.pages.dev

2024 4th Quarter Estimated Tax Payment Gabey Shelia, You may file and pay your 2024 connecticut estimated tax using myconnect. The 2024 tax rates and thresholds for both the connecticut state tax tables and federal tax tables are comprehensively integrated into the connecticut tax calculator for.

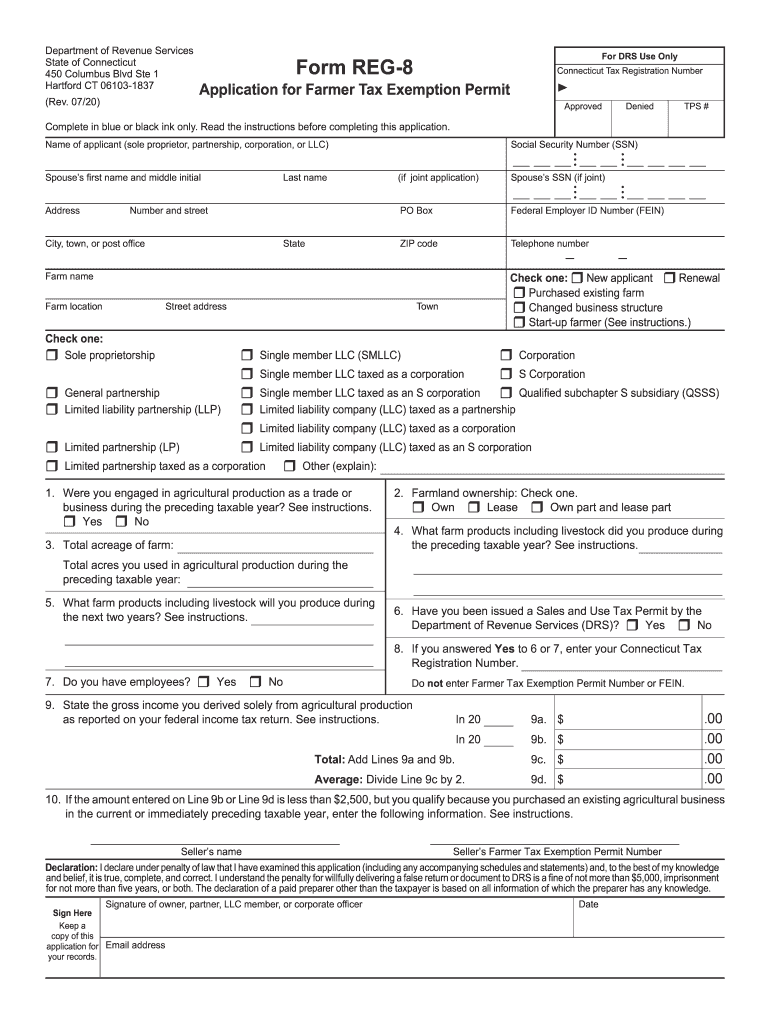

Source: www.dochub.com

Source: www.dochub.com

Connecticut form reg 8 Fill out & sign online DocHub, Benefits to electronic filing include: Calculate your connecticut state income taxes.

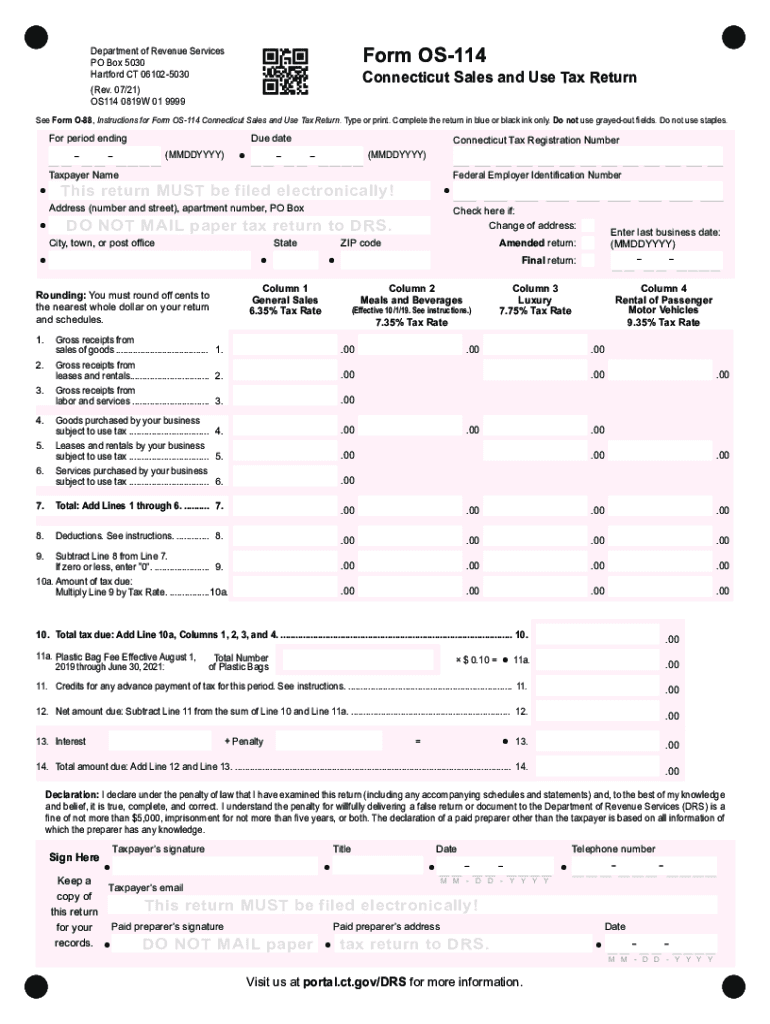

Source: www.signnow.com

Source: www.signnow.com

Ct Sales Tax 20212024 Form Fill Out and Sign Printable PDF Template, The impacted connecticut returns and the associated filing dates and payment deadlines, which now are due june 17, 2024, are as follows: Benefits to electronic filing include:

Source: lydieqsimone.pages.dev

Source: lydieqsimone.pages.dev

Nys Estimated Tax Payments 2024 Denyse Gerianne, Penalties on payroll and excise tax deposits. Learn how and when to make an estimated tax payment in 2024 — plus find out whether you need to worry about them in the first place.

You May File And Pay Your 2024 Connecticut Estimated Tax Using Myconnect.

You may also make your payments by credit card.

Benefits To Electronic Filing Include:

Calculate your annual salary after tax using the online connecticut tax calculator, updated with the 2024 income tax rates in connecticut.